We Help Amazon Agencies Scale Fast with White-Label Operations

Plug in a proven back-office engine so you can sell more, stress less, and grow quicker.

Does this sound familiar?

- You’re an experienced Amazon operator branching out into your own agency.

- You’ve already started but struggle to hit consistent growth.

Growth Feels Stuck because:

- Ops consume your day, leaving little time for sales and expansion.

- Reliable, execution-ready talent is hard to find and keep.

- Competing on price is tough when payroll is heavy.

- Hiring, training, and managing quality resources feels never-ending.

Where Upriver Global fits in

We’re a B2B, agency-first partner that embeds with your team and handles the end-to-end Amazon workload, so you can stay focused on winning clients and scaling revenue.

- Lift client sales

- Remove 90% of ops friction

- Cut ops costs (up to ~70%)

- Scale without adding headcount

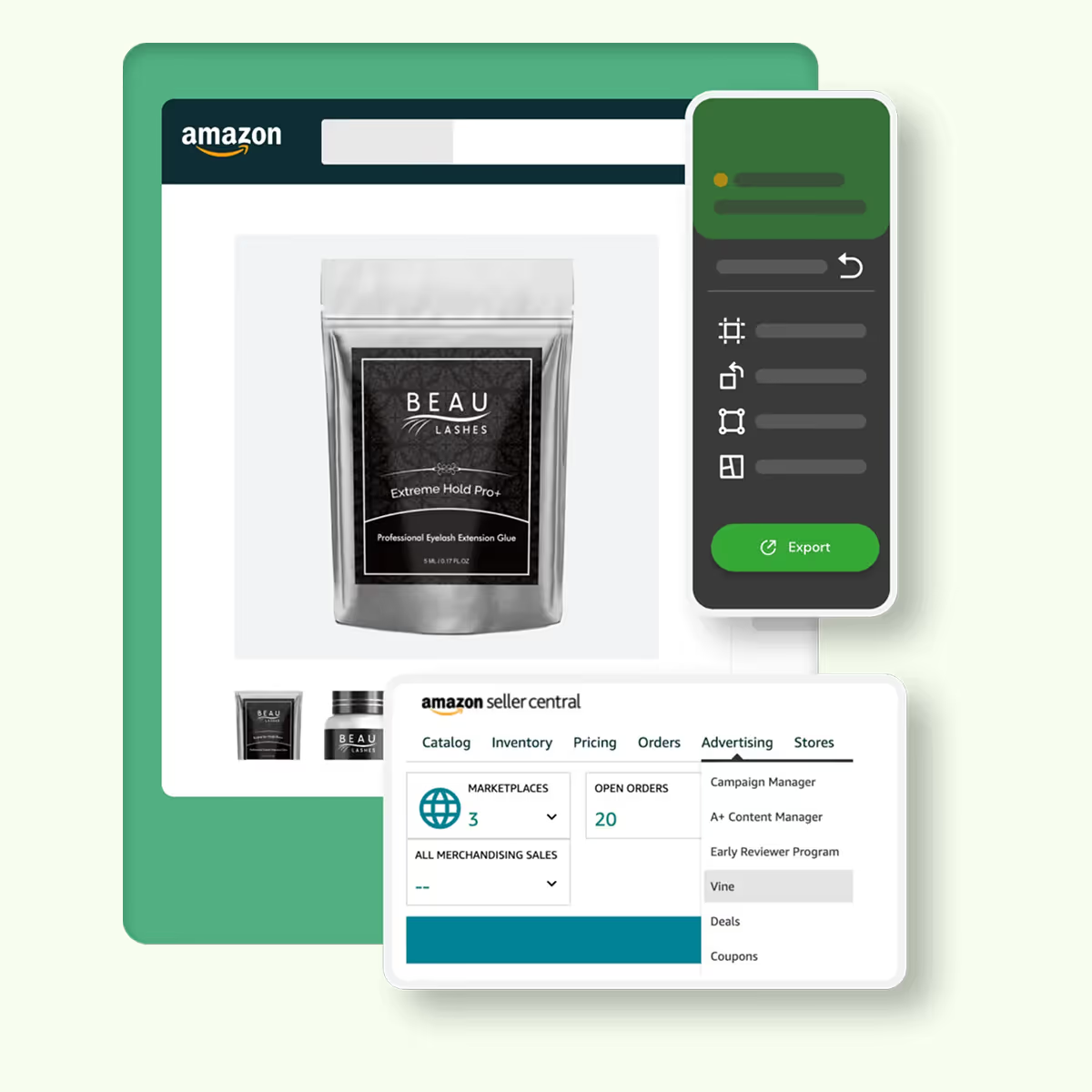

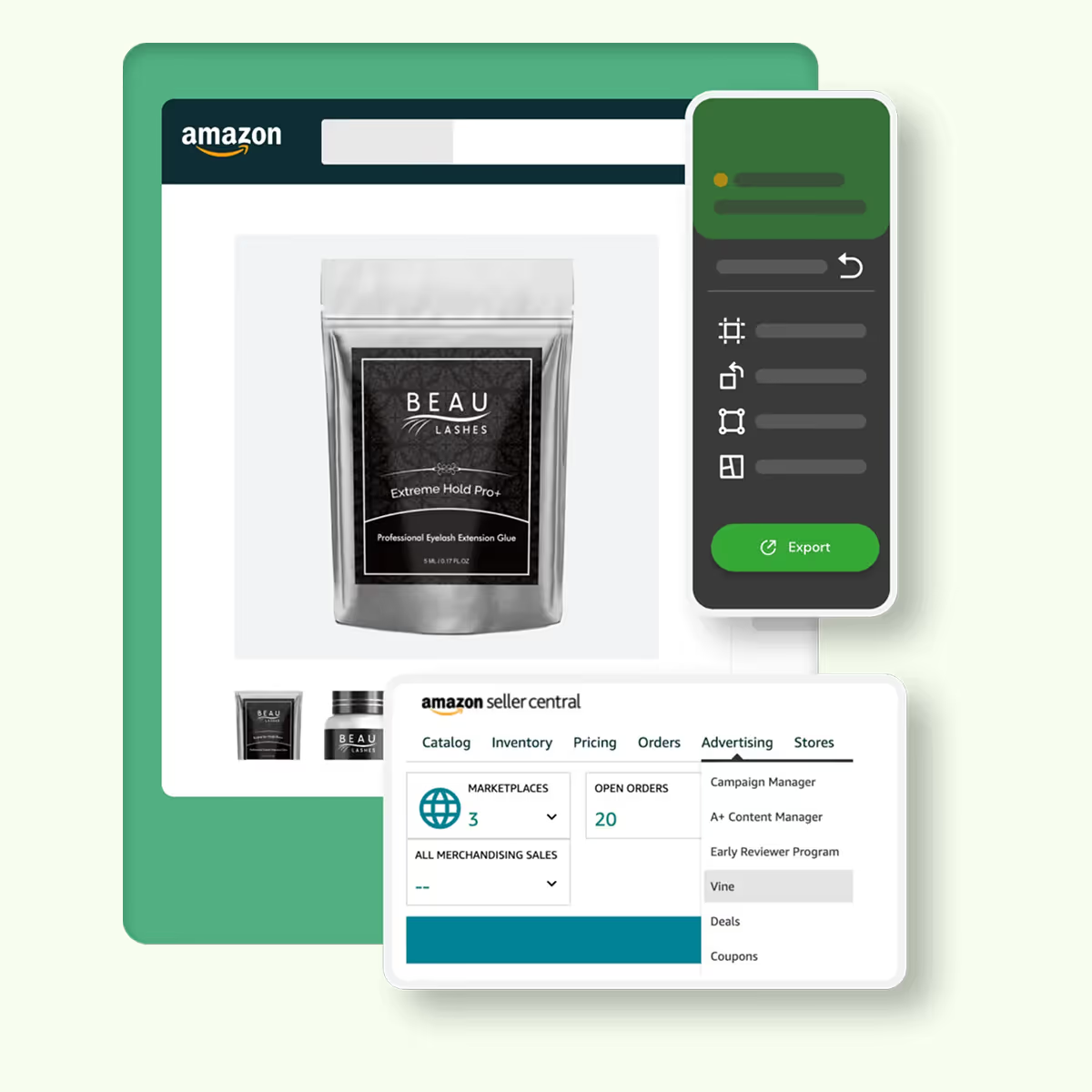

Services Built for Agencies

Services Built for Agencies

Full-Service Brand Management

We run listings, ops, and growth so your clients see momentum and you keep the relationship.

Amazon PPC Advertising

Performance-led campaign design and optimization to improve ROAS and profitability.

Creative Services

Listing images, A+ Content, and brand stories that lift CTR and conversion.

Spend More Time Growing—Less Time Firefighting

Common Roadblocks We Neutralize

Low retention, inconsistent delivery, inefficient PPC, rising TACoS, price wars, listing hijacks, conversion issues, talent churn, high operating costs, and outdated marketplace tactics.

Low Client Retention

Inefficient PPC Strategies

Inconsistent Results

Difficulty Retaining Talent

Difficulty Retaining Talent

High Operational Expenses

Creatives Outsourcing

Outdated Amazon Strategies

Common Roadblocks We Neutralize

Low retention, inconsistent delivery, inefficient PPC, rising TACoS, price wars, listing hijacks, conversion issues, talent churn, high operating costs, and outdated marketplace tactics.

Spend More Time Growing—Less Time Firefighting

Low Client Retention

Inefficient PPC Strategies

Inconsistent Results

Difficulty Retaining Talent

Difficulty Retaining Talent

High Operational Expenses

Creatives Outsourcing

Outdated Amazon Strategies

What Partner Agencies Typically See

We work deeply with a small set of partners to drive durable growth. Examples include multi-X YoY revenue expansion, strong client stickiness, and founders freed up to brand, sell, and scale.

Our Growth Method to Scale Your Clients

Audit

In the first 5–7 business days we run a 360° diagnostic across retail readiness and catalog hygiene (suppressions, variation logic, Buy Box, pricing/fees, inventory health), demand and SEO (indexing gaps, Search Query Performance, share of search), creatives and conversion (main-image CTR drivers, A+, Brand Story, video, store flow, review velocity/return reasons), advertising and profitability (ACOS/TACoS by cohort, wasted-spend pockets, placement multipliers, match-type mix, new-to-brand, contribution margins), plus compliance risks. You receive a 20-page audit with R/A/G scoring per ASIN and workstream, a prioritized 90-day roadmap with owners and effort/impact, and a measurement plan locking baselines for CTR, CVR, sessions, indexing, ACOS/TACoS, contribution margin, in-stock %, and share of voice.

Optimize

Before scaling spend, we fix foundations to unlock “free” gains in visibility and conversion: rewrite titles, bullets, and backend keywords to index the right terms; upgrade creatives with conversion-led image stacks, A+ and Brand Story modules, and 15–30s videos; restructure the Brand Store pathways; correct variations and clear suppressions; align coupons and promos to rank windows; and refine review request flows. In parallel, we schedule experiments (main-image CTR, A+ variants, price/coupon tests, store layouts). The output is optimized PDPs and store, a live testing slate, and a conversion checklist per ASIN—typically moving indexing coverage, CTR, sessions, and CVR up while suppressions and “not as described” returns decline during weeks 2–4.

Invest

We then redeploy wasted spend into winning intent by rebuilding the account around clear goals—rank (exact/top-of-search), defend (brand), harvest (auto/broad), conquest (PAT/competitor), and profitability (ROAS-guard). Match-type separation and a disciplined negative map stop bleed; bids and budgets shift to proven queries and green ASIN cohorts; placement multipliers and dayparting are tuned; and product targeting deepens around hero SKUs with variation-aware ads. Expect a clean architecture, query-to-campaign routing rules, and a weekly pacing sheet—alongside wasted-spend reduction, better ACOS/TACoS, higher ROAS, rising click share on priority terms, and, where relevant, stronger new-to-brand—typically across weeks 3–6.

Scale

Finally, we compound what works without breaking margins or stock: push depth by increasing bids/budgets on high-intent exact terms and cloning winners by placement; add breadth via demand-led variations and bundles, adjacent keywords, seasonal plays, and fresh video/SBV angles; and expand surface area to Walmart, TikTok Shop, or international marketplaces once PDPs and ops are stable. Guardrails keep rank pushes aligned with inventory pacing, FBA storage and restock plans healthy, and pricing protected for the Buy Box. From weeks 6–12 onward, you should see sustained lifts in incremental revenue, category rank and share of voice, blended CVR, and repeat purchase rate, with stockouts and aged units trending down.

Our Growth Method to Scale Your Clients

Audit

In the first 5–7 business days we run a 360° diagnostic across retail readiness and catalog hygiene (suppressions, variation logic, Buy Box, pricing/fees, inventory health), demand and SEO (indexing gaps, Search Query Performance, share of search), creatives and conversion (main-image CTR drivers, A+, Brand Story, video, store flow, review velocity/return reasons), advertising and profitability (ACOS/TACoS by cohort, wasted-spend pockets, placement multipliers, match-type mix, new-to-brand, contribution margins), plus compliance risks. You receive a 20-page audit with R/A/G scoring per ASIN and workstream, a prioritized 90-day roadmap with owners and effort/impact, and a measurement plan locking baselines for CTR, CVR, sessions, indexing, ACOS/TACoS, contribution margin, in-stock %, and share of voice.

Optimize

Before scaling spend, we fix foundations to unlock “free” gains in visibility and conversion: rewrite titles, bullets, and backend keywords to index the right terms; upgrade creatives with conversion-led image stacks, A+ and Brand Story modules, and 15–30s videos; restructure the Brand Store pathways; correct variations and clear suppressions; align coupons and promos to rank windows; and refine review request flows. In parallel, we schedule experiments (main-image CTR, A+ variants, price/coupon tests, store layouts). The output is optimized PDPs and store, a live testing slate, and a conversion checklist per ASIN—typically moving indexing coverage, CTR, sessions, and CVR up while suppressions and “not as described” returns decline during weeks 2–4.

Invest

We then redeploy wasted spend into winning intent by rebuilding the account around clear goals—rank (exact/top-of-search), defend (brand), harvest (auto/broad), conquest (PAT/competitor), and profitability (ROAS-guard). Match-type separation and a disciplined negative map stop bleed; bids and budgets shift to proven queries and green ASIN cohorts; placement multipliers and dayparting are tuned; and product targeting deepens around hero SKUs with variation-aware ads. Expect a clean architecture, query-to-campaign routing rules, and a weekly pacing sheet—alongside wasted-spend reduction, better ACOS/TACoS, higher ROAS, rising click share on priority terms, and, where relevant, stronger new-to-brand—typically across weeks 3–6.

Scale

Finally, we compound what works without breaking margins or stock: push depth by increasing bids/budgets on high-intent exact terms and cloning winners by placement; add breadth via demand-led variations and bundles, adjacent keywords, seasonal plays, and fresh video/SBV angles; and expand surface area to Walmart, TikTok Shop, or international marketplaces once PDPs and ops are stable. Guardrails keep rank pushes aligned with inventory pacing, FBA storage and restock plans healthy, and pricing protected for the Buy Box. From weeks 6–12 onward, you should see sustained lifts in incremental revenue, category rank and share of voice, blended CVR, and repeat purchase rate, with stockouts and aged units trending down.

Testimonials

Testimonials

Since partnering with Upriver Global, our Amazon business have dramatically. They know exactly which levers to pull and stay laser-focused on growth.

They’re there when we need them, and the numbers prove it, sales are up and their commitment shows through every week.

Not just ‘store management’—they help us win. Strategy, execution, and accountability in one place.

Best decision we made. A hands-on team that actually moves the needle—our Amazon results hit the next level.

In a few months, sales surged while margins held. They understand profitable scaling.

They took the operational load off so we could focus on growth—everything runs tighter, costs are down, and we’re scaling again.

Ready to Transition from 7 to 8 Figures on Amazon?

We Help You Build and Scale Your Amazon Agency

Our team has a successful track record of helpingbrands scale profitably based on the high-performingmarketing strategy designed by top experts.

We Put Customers First

Your clients' success is our success. We're obsessed with client retention and focused on maximizing the lifetime value (LTV) of every client you close.

Proven Results

Upriver has a proven track record of boosting revenue, increasing conversions, and maximizing ROI for Amazon brands.

No. Upriver Global operates strictly as your white-label operations partner. We do not pitch, contract with, or service your clients directly. All communication, deliverables, and invoicing run through your agency, under your brand.

Safeguards we put in place

- Mutual NDA + non-solicitation / non-circumvention covering your clients and prospects

- We can work via your email domain/Slack/PM tools and follow your SOPs

- Any inbound from your clients is routed back to you immediately

- Conflict checks and category/region exclusivity on request

- Data residency in your workspaces; access revoked instantly on offboarding